It is not only a means of risk management under the conditions of market economy, but also a tool for planning your own wealth and improving your risk bearing capacity. It is an important pillar of the financial system and social security system. From the perspective of economics, insurance is an investment behavior that shares its own risks. From a social perspective, it‘s an important part of the social security system. Nowadays, insurance has covered all aspects of life. Do you know how insurance has developed to the present? Come and learn about it.

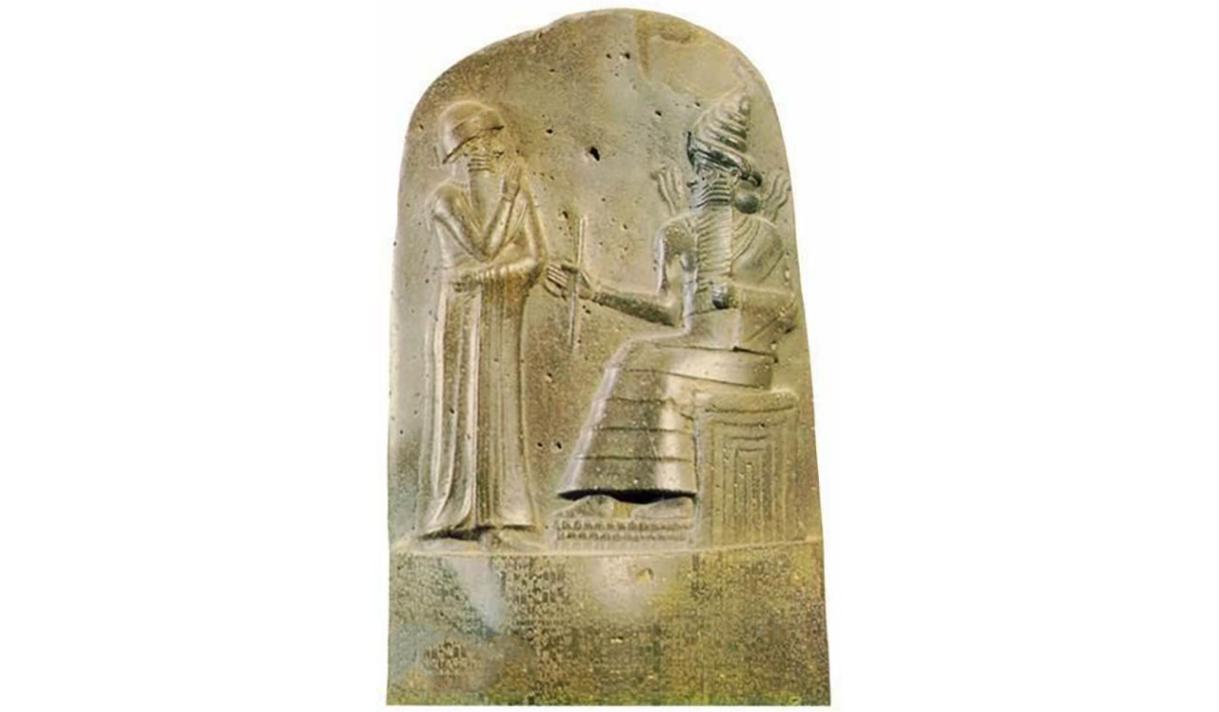

As early as BC, people in the struggle against nature, faced with endless natural disasters and accidents, sprouted the original form of insurance methods. One of them is that around 2500 A.D., in the ancient Babylonian Kingdom, the king ordered monks, judges, village chiefs, etc. to collect taxes as the fund for fire relief due to the frequent occurrence of fires. In about 1792 AD, Hammurabi, the sixth generation king of Babylon, in order to develop commerce and protect the loss of caravan goods, wrote the clause of sharing losses into his Hammurabi code. At the same time, some soldier organizations in ancient Rome would provide living expenses for the families of soldiers who died in battle by raising funds. These are the embryonic forms of ancient insurance. Another popular saying is that there is a small village in the Baltic Sea that lives by fishing. Because most of the men in the village lived by fishing at that time, and the weather was often bad, which led to ship accidents, the local women organized to initiate a system of "rescue money", and each family regularly paid a fixed fee. In case of a maritime accident, the families of the victims who paid the "rescue money", You can get compensation for your future life from this money, which is also a precedent for insurance.

In October 1347,a captain named Basharomo Basso received a big contract at the end of the sailing season. According to the contract, if he arrives at the destination safely at the specified time, he will be rewarded. But if the goods are damaged, he will compensate double the value of the goods. To be on the safe side, he found himself a guarantor named George Luckvelen. The captain shall pay a certain amount of remuneration to George Luckvelen in advance. If the captain arrives at the destination safely within 6 months, George will receive this part of remuneration and will not return it to the captain; If the captain encounters any loss during transportation, George Luckvelen will compensate for the captain and compensate for the litigation costs incurred. This is the origin of the first insurance policy in the world, and this case is also known as the origin of modern marine insurance.

From the mutual aid form in the embryonic period, insurance gradually developed into adventure lending, then marine insurance contract, marine insurance, fire insurance, life insurance and other insurance, and gradually developed into modern insurance. That sounds interesting. If you like our passage and also think it funny, please follow us.